Pass on the MRN in the export logistics chain

As an exporter, you must provide the correct operator with the MRN of the export declaration. Therefore, you must know which operators will provide information in the later steps.

The export process consists of data filing in three steps:

- Step 1 – Export declaration

- Step 2 – Arrival at exit

- Step 3 – Exit notification

As an exporter, you must provide the correct operator with the MRN of the export declaration. The MRN must then be passed on to the operator who submits the notification of exit of goods in step 3. Therefore, you must know which operators will provide information in the later steps.

The MRN should be passed on

The export process begins when the declarant or their representative submits an export customs declaration using message IE515.

First, a message IE528 is received with the MRN number, followed by a message IE529 stating that the goods have been released for export. The shipment can now be released.

Have you received an MRN in return (IE528) but have not received the release for export notification (IE529)?

This means that the case has been moved to manual processing by Swedish Customs. Wait for a message about possible control or release.

Based on this information in the export declaration, the declarant or their representative must pass on the MRN number in the logistics chain to an operator at the place of exit, as this operator must submit a notification of goods to the customs office of exit in step 2 using message IE507.

The legislation does not specify who is responsible for submitting the arrival at exit message. This responsibility can fall on various actors, such as a port or airport terminal.

The MRN must then be passed on to the operator who submits the notification of exit of goods in step 3.

How the MRN number is communicated and to whom is up to you to decide in consultation with the other parties involved.

Three possible scenarios

The following three scenarios show examples of how MRN numbers are passed on in the logistics chain.

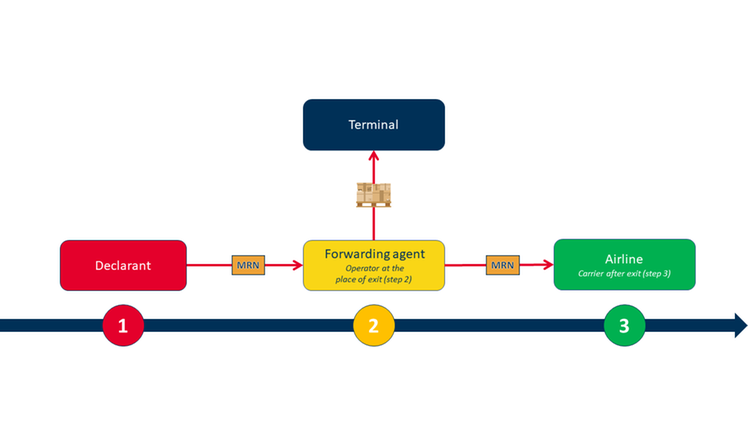

Scenario 1: direct export – by air (not STC)

A possible scenario:

The declarant engages a forwarding agent to transport the goods out of the EU. The goods are to be transported by lorry to the airport terminal and then transported directly by air to a country outside the EU (without stopping in the EU).

The same scenario applies to direct exports by other modes of transport.

- The declarant, or a representative hired by the declarant, sends the MRN number of the export customs declaration (along with a note saying ‘not STC’) to the next party in the logistics flow, in this case the forwarding agent. If the forwarding agent has acted as the declarant’s customs representative in the export declaration, they already have the MRN number for the file.

- The forwarding agent acts as the operator at the place of exit.

- The forwarding agent submits an Arrival at exit (IE507) message when the goods are at the approved place of exit (step 2).

- When the goods are released for exit (Exit release notification; IE525), the aircraft is allowed to take off.

- The forwarding agent then acts as the representative of the airline (carrier after exit) and submits the Exit notification (IE590) (step 3).

- The declarant or the declarant's representative receives an Exit certificate (IE599).

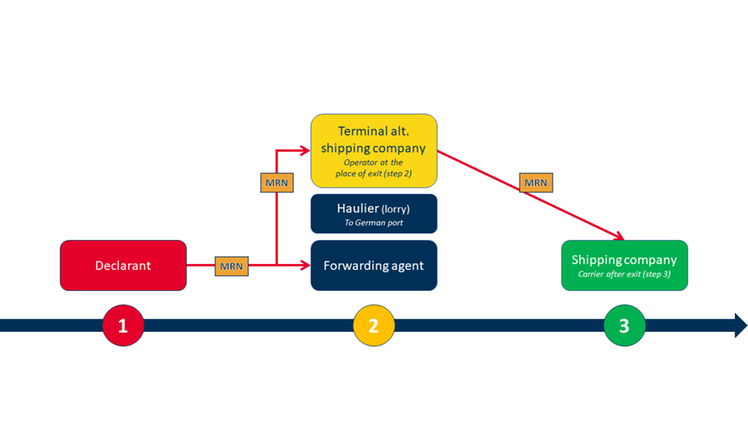

Scenario 2: Indirect export – by sea (not STC)

A potential scenario:

The declarant engages a forwarding agent to transport the goods out of the EU. The goods are transported by lorry to a port in Germany. There, they are loaded onto a ship for transport out of the EU. The declarant has not requested the STC procedure.

The same scenario applies to indirect exports by other modes of transport.

- The declarant, or a representative hired by the declarant, sends the MRN number of the export customs declaration (along with a note saying ‘not STC’) to the next party in the logistics flow, in this case the forwarding agent. If the forwarding agent has acted as the declarant’s customs representative in the export declaration, they already have the MRN number for the file.

- The forwarding agent sends the MRN number of the export customs declaration to the operator at the place of exit – in this case to the terminal in the port where the goods are to leave the EU, or alternatively to the shipping company.

- The terminal, or alternatively the shipping company, acts as the operator at the place of exit and submits an Arrival at exit (IE507) message (step 2).

- The terminal sends the MRN number of the export customs declaration to the next party in the logistics flow, in this case to the shipping company of the vessel. If the shipping company has submitted IE507, they already have the MRN number for the file.

- The shipping company acts as the carrier after export and submits an Exit notification (IE590) (step 3). The shipping company may also engage a representative to submit the information, for example a forwarding agent.

- The declarant or the declarant's representative receives an Exit certificate (IE599).

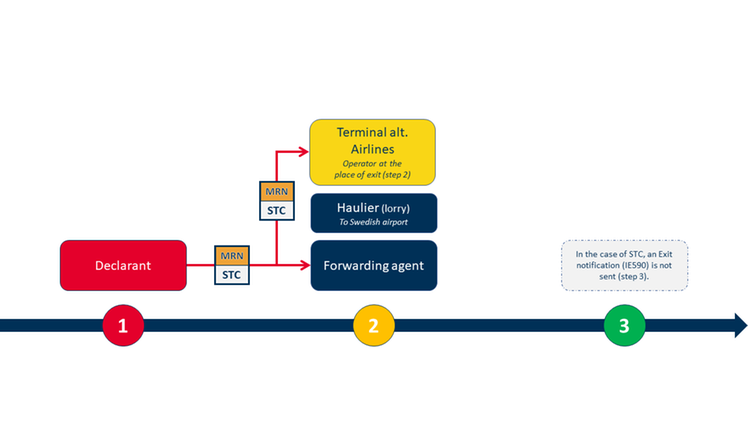

Scenario 3: STC

What is STC?

The Single Transport Contract (STC) is a simplification where data is submitted in only two steps. A through-bill of lading is required. An STC can be used for transport by sea, air, rail and road.

More information about STC and when it can be applied can be found here:

STC – Single Transport Contract (in Swedish)

How to declare when using an STC

If STC is possible, you can request the application of STC in the export declaration by entering code 30500 in data element 12 02 008 000, Additional information.

The customs office of exit is specified in the export declaration in data element 17 01 000 000.

Declaration guide for standard customs declarations for exports (in Swedish)

A possible scenario:

The declarant engages a forwarding agent to transport the goods out of the EU. The declarant wishes to invoke the simplified export procedure STC and enters code 30500 in the declaration and refers to the through bill of lading they have drawn up with their forwarding agent.

The goods are transported by lorry to an airport in Sweden. There, the goods are loaded onto a flight for transport to an airport in another Member State. The goods are then transferred to another flight for transport out of the EU.

The same scenario applies to STC for transport by sea, rail and postal consignments.

- The declarant, or a representative appointed by the declarant, sends the MRN number of the export customs declaration and information that STC is to be used to the next party in the logistics flow, in this case the forwarding agent (suggestion: MRN number + clarifying note ‘STC’). If the forwarding agent has acted as the declarant's customs representative in the export declaration, they should already have the MRN number for the case.

- The forwarding agent sends the MRN number of the export customs declaration and information that STC is to be used to one or more operators at the place of exit, in this case the terminal that holds a decision on an approved place of exit at the airport where the goods are taken over within the framework of the through freight operation, or alternatively to the airline.

- The terminal or airline is the operator at the place of exit and submits an Arrival at exit (IE507) message (step 2).

- When the goods are released for exit (Exit release notification; IE525), the aircraft is allowed to take off.

- In the case of STC, an Exit notification (IE590) is not sent (step 3).

- The declarant or the declarant's representative receives an Exit certificate (IE599).

Find information in the online service Status query

An online service for checking the status of your case, where you can enter the MRN number to find out the status of your declaration. To see a list of the statuses that can be displayed and an explanation of them, follow the link below.

You can also see which customs office of exit has been specified in the export declaration and whether a STC has been applied.