Future developments in the customs area

On this page, you can follow what is happening in the coming years. You can also read about other ongoing developments.

Foto: Mette Ottosson

Customs legislation in the EU

The current customs legislation, the Union Customs Code (UCC), became applicable in 2016. The purpose of the Union Customs Code is to simplify customs legislation and administration, both from the perspective of businesses and customs authorities. This is done by ensuring that all handling is done digitally and more uniformly, both in terms of the exchange of information between authorities and industry, but also in terms of the exchange of information between customs administrations within the EU.

MASP-C – the multi-annual plan for the implementation of various IT systems

The Commission is working with the EU Member States in the customs territory on what is known as the Multi Annual Strategic Plan (MASP). The MASP is the plan for the implementation of the various IT systems required, including to cope with changes in legislation. There is an annual update of the MASP with decisions in the Customs Policy Group in December each year.

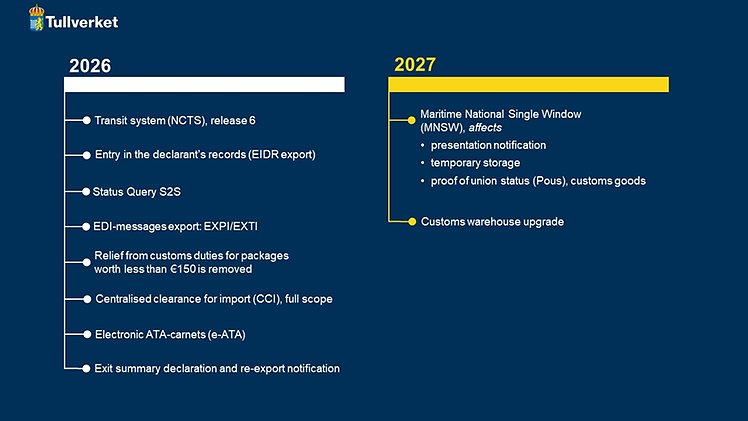

Schedule for the introduction of, and migration to, new systems

The transition to fully digitised customs management is underway. Large parts of the import and export systems are in place, but development work continues.

Zoom image

Zoom imageThe picture shows the overall changes that are planned. In the timeline below, you can read more about the times that are relevant for the different systems. The timeline is updated continuously.

2026

The New Computerised Transit System, Phase 6 (NCTS-P6)

NCTS-P6 is a continuation of NCTS-P5. Implementation in the EU started in 2025. NCTS-P6 will be implemented in Sweden in the end of February 2026.

The New Computerised Transit System (NCTS)

Entry in the declarant's records (EIDR for export)

Entry in the declarant's records (EIDR) for export will be introduced on 26 February 2026, with a transition period that runs until 31 March 2026.

The level of details in these records must correspond with the requirements for a simplified declaration. There will also be a requirement to notify Swedish Customs whenever an entry is made in the declarant’s records.Entry in the declarant's records (EIDR for export)

Status query (S2S)

Swedish Customs is enabling the Status query function as a system-to-system solution. Implementation is scheduled for the end of April 2026.

Service messages EXPI and EXTI (export)

Swedish Customs is developing digital messages to facilitate the export process in a system-to-system solution. Implementation is scheduled for the end of April 2026.

Duty relief for consignment of negligible value (less than EUR 150) is removed

The threshold value for customs duties, €150, will be abolished on 1 July 2026. A customs duty of €3 per item will then be introduced for consignments whose total value does not exceed €150.

The Reform Package – A reform of the Customs Union (in Swedish)

Centralised customs clearance for import (CCI), full scope

Centralised customs clearance will be implemented in two parts. The first part covered standard customs declarations and was introduced in Sweden in 2025. The second part covers simplified and supplementary declarations as well as entry in the declarant's records and will be introduced in Sweden on 1 September 2026.

Centralised customs clearance (import)

Electronic ATA carnets (e-ATA)

ATA carnets are based on two international conventions (the ATA Convention and Annex A of the Istanbul Convention) which make it possible to simplify customs formalities in connection with the temporary entry and exit of goods in different countries. In Sweden, ATA carnets are issued by a competent chamber of commerce.

The International Chamber of Commerce (ICC) has developed a digital system to replace the current paper-based system. The EU's goal is for all Member States to switch to electronic ATA carnets 1 June 2026. Globally, the transition will take place gradually. This means that ATA carnets will be handled both digitally and in paper format during a transition period.

Exit summary declaration and re-export notification

An online service is being developed for cases where an export declaration is not to be submitted and you instead need to submit a separate exit summary declaration. The online service will be introduced in autumn 2026.

An online service is being developed for re-export notifications, for example for goods that are in temporary storage and must be notified for re-export. The online service will be introduced in autumn 2026.

Exit summary declaration and re-export notification (in Swedish)

2027

Maritime National Single Window (MNSW)

The Maritime National Single Window (MNSW) introduces the national elements of the European Maritime Single Window environment (EMSWe), which will enable all ship reporting to be done to one contact point per Member State. The Swedish Maritime Authority is responsible for this point of contact. It will be possible to submit required for customs purposes, i.e., notification of arrival of goods and temporary storage, using this single point of contact.The Swedish Environmental Protection Agency is the competent authority in Sweden.

The implementation in Sweden is scheduled for Q3, 2027. The MNSW will then replace the Maritime Single Window (MSW), the current system. AS per the EMSWe Regulation, the launch date of the MNSW was 15 August 2025. The impact of this change in the timetable on customs formalities in the form of presentation notifications and temporary storage in the maritime flow is being analysed. For the time being, the existing transitional solution is used.

Information about EMSW – Swedish Maritime Administration (in Swedish)

Frequently asked questions about EMSW – Swedish Maritime Administration (in Swedish)

Proof of Union Status, manifest for customs purposes

PoUS Phase 2 includes manifests for customs purposes, also known as Customs Goods Manifest, CGM. The plan is for the CGM to be fully implemented at the same time as the MNSW (Maritime National Single Window) – the future digital interface for reporting in maritime transport. The intention of the CGM is for data submission to be integrated with the MNSW. The information is then automatically forwarded to the PoUS system, which is managed by the EU customs authorities.

PoUS Phase 2 (Customs Goods Manifests)

Customs warehouse upgrade

The current customs warehousing system needs to be upgraded to fully comply with the reporting requirements set out in Annex B to the Customs Code. This upgrade is currently being analysed.

Learn more

Here you will find information needed for system developers that are developing a customs EDI-system or companies developing an in-house system.