How to interpret your customs bill

Do you find it hard to understand what your customs bill means? Here you can find explanations for certain fields and abbreviations, you can also see an example of a customs bill.

You need authorisation for deferment of payment from Swedish Customs to pay your fees via a customs invoice, instead of directly at the time of importation. You will be registered as a creditor once you have been granted authorisation.

Authorisation for deferment of payment

You may also hire a representative with an authorisation for deferment of payment to assume liability.

Learn more about your responsibilities as a declarant when using a representative (in Swedish).

Please contact Swedish Customs if you know that you were supposed to receive a customs invoice but did not.

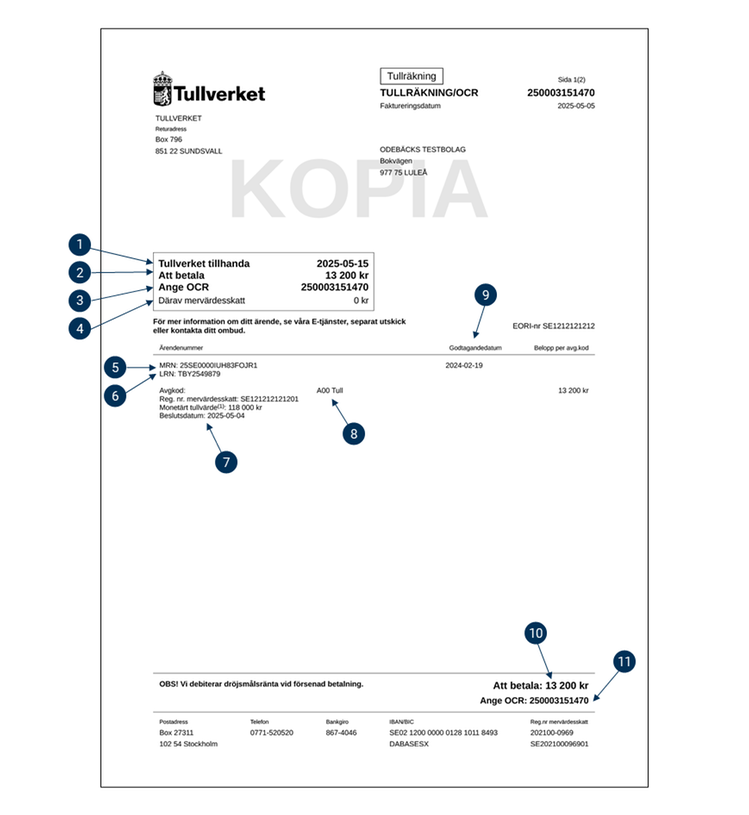

An example of what a customs bill might look like

Zoom image

Zoom imageClick on the image to zoom.

Explanations of texts in the customs bill

Nr | Swedish | English |

|---|---|---|

1 | Tullverket tillhanda | Due date for payment |

2 | Att betala | Total amount payable in SEK, including VAT |

3 | Ange OCR | Enter OCR (please refer to this number when you pay the bill) |

4 | Därav medvärdesskatt | VAT amount included in the amount above |

5 | MRN | MRN (Master Reference Number), the ID number for the declaration

|

6 | LRN | LRN (Local Refence |

7 | Avgkod

Reg. nr. medvärdesskatt

Monetärt tullvärde

Beslutsdatum | Data for VAT purposes

Reg.nr

Monetary customs value

Date of decision and legal reference |

8 | Type of tax. Valid codes are listed in the Taric Query System on tullverket.se | |

9 | Godtagandedatum | Date of acceptance |

10 | Att betala | Total amount payable in SEK, including VAT |

11 | Ange OCR | Enter OCR (please refer to this number when you pay the bill) |

When do I have to pay?

Payment must be made to Swedish Customs' bankgiro number or to our account for payments from abroad with BIC and IBAN account numbers no later than the date stated on the customs invoice. Please note that it may take some time for your payment to reach us, depending on the payment method. Please make sure to make the payment well in advance.

The payment must be made on time, even if the customs invoice is delayed or has gone missing.

If the customs invoice is not paid on time, we will charge interest on arrears. We will charge this from the first day after the date on which the customs invoice should have been paid.

How do I pay?

If you make your payment from abroad please make your payment to our BIC code and IBAN account number, which you will find at the bottom of the customs invoice.

If you are a Swedish company, please pay your customs invoice to Swedish Customs’ Bankgiro number 867-4046. The OCR is the same as your customs invoice number.

Customs invoices can be also paid by Autogiro (direct debit). Complete and submit this form to pay by Autogiro:

Medgivande till betalning genom autogiro företag (in Swedish) pdf, 276.8 kB.

Customs invoice credit

If the customs invoice contains a credit amount, we will settle it with a payment. You cannot settle it yourself by deducting the credit amount from another customs invoice. If you already owe us an amount or have a debt registered with the Swedish Enforcement Authority, the credit amount will be used to pay that debt instead2. However, if you are registered for VAT, we will not refund the VAT.

1) Chapter 2, Section 8 of the Customs Act (2016: 253) and Article 114 of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code (the Customs Code).

2) Chapter 2, Section 19, fourth paragraph of the Customs Act.