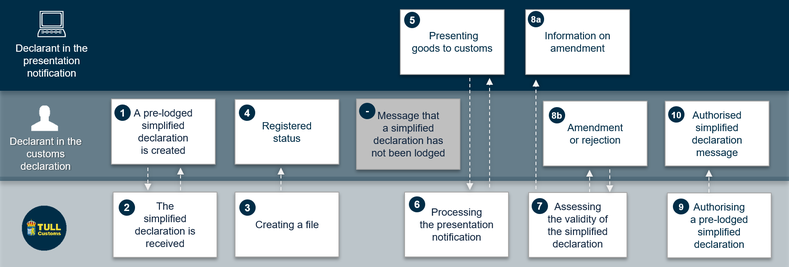

Procedure when pre-lodging a simplified declaration

A customs declaration should always be submitted to Swedish Customs when goods are imported from countries outside the EU. One option is to submit a simplified declaration, followed by a supplementary declaration. A simplified declaration can be pre-lodged and activated once the goods arrive.

A simplified declaration contains less information about your consignment than a standard customs declaration. The remaining information is subsequently provided in a supplementary customs declaration. An authorisation is needed to use a simplified declaration.

A simplified declaration can be pre-lodged and activated once the goods arrive.

The image below describes how to pre-lodge a simplified declaration. Below the image, you can read descriptions of the roles and what happens at each stage.

Zoom image

Zoom imageClick on the image to enlarge

Roles

There may be a declarant both in a customs declaration and in a presentation notification. To distinguish between these roles, this procedure will use the following designations:

- Declarant in the customs declaration

- Declarant in the presentation notification.

A declarant may hire a representative who will handle their communications with Swedish Customs. The representative acts on behalf of the declarant. In this specification, it is stated that Swedish Customs will communicate with the declarant, regardless of whether the communication takes place directly with the declarant or via the declarant's representative.

Declarant in the customs declaration

The declarant in the customs declaration is the person lodging a customs declaration or an amendment request, or amending a pre-lodged customs declaration.

Declarant in the presentation notification

The declarant in the presentation notification is the person presenting the goods to customs at the border.